End-to-end insurance support for therapists

Expert guidance through the insurance ecosystem

Included for all members

Simplify credentialing, claims, and beyond with Alma’s suite of tools and experts. We navigate the complexities of taking insurance so you don’t have to.

Credentialing time

45 days or less

Payout Schedule

Weekly

People eligible for in-network care

112 million+

Make insurance work for you, without the hard work.

Bring quality care to more clients

By accepting insurance, Alma members can expand their client base beyond cash pay and provide services to more individuals in need.

Alma smooths this process for you and your clients, by offering:

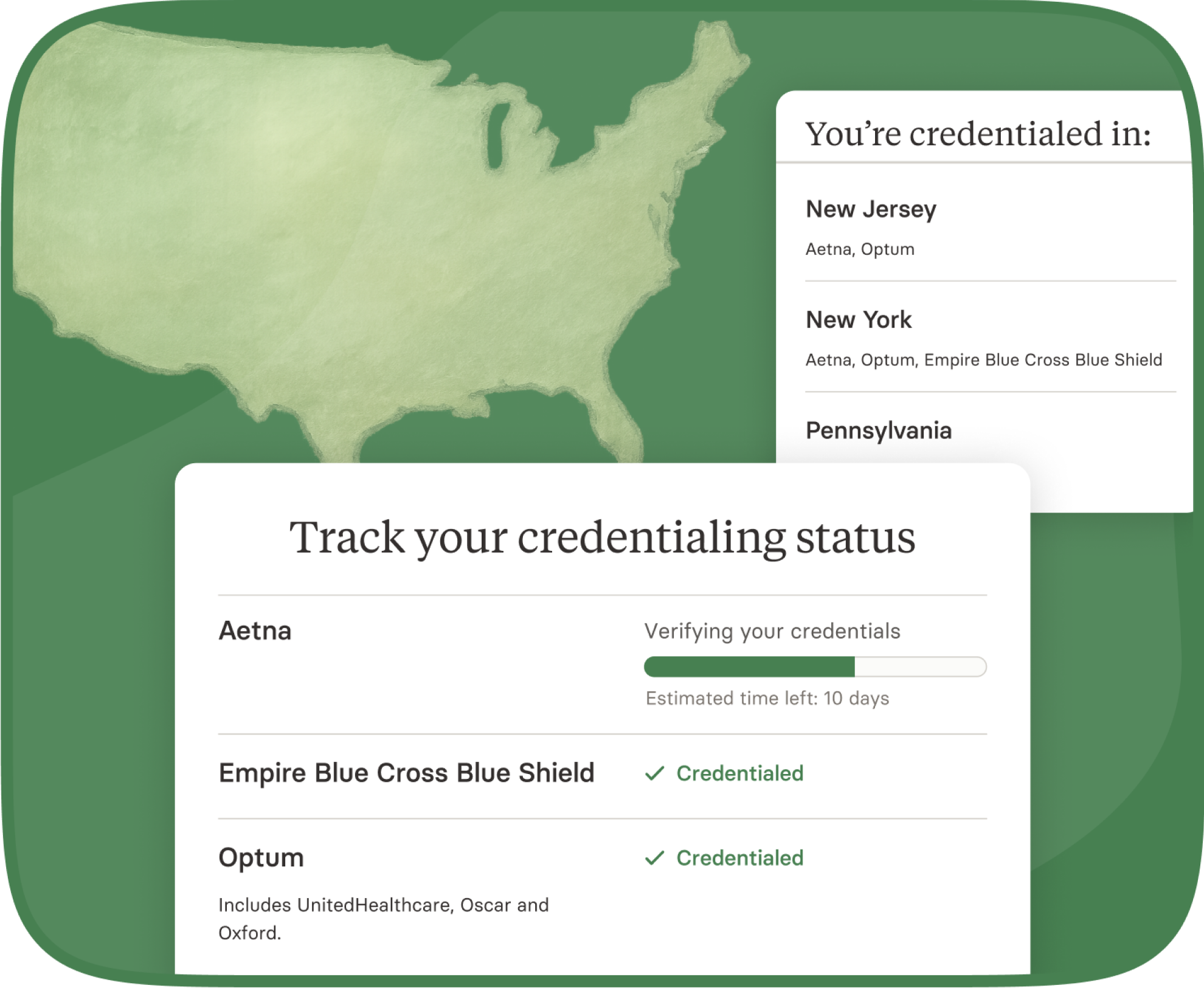

Credentialing 3 times faster than individual applications

A network of Alma insurance partners in all 50 states

Multi-state credentialing

Access to clients who engage in ongoing care (3+ visits on average)

Streamline processes and reduce paperwork

Accept payments, submit claims, and get timely payouts, all in one place. Alma's platform handles the core insurance eligibility and billing process so you can save time, lower overhead, improve client relationships, and earn more.

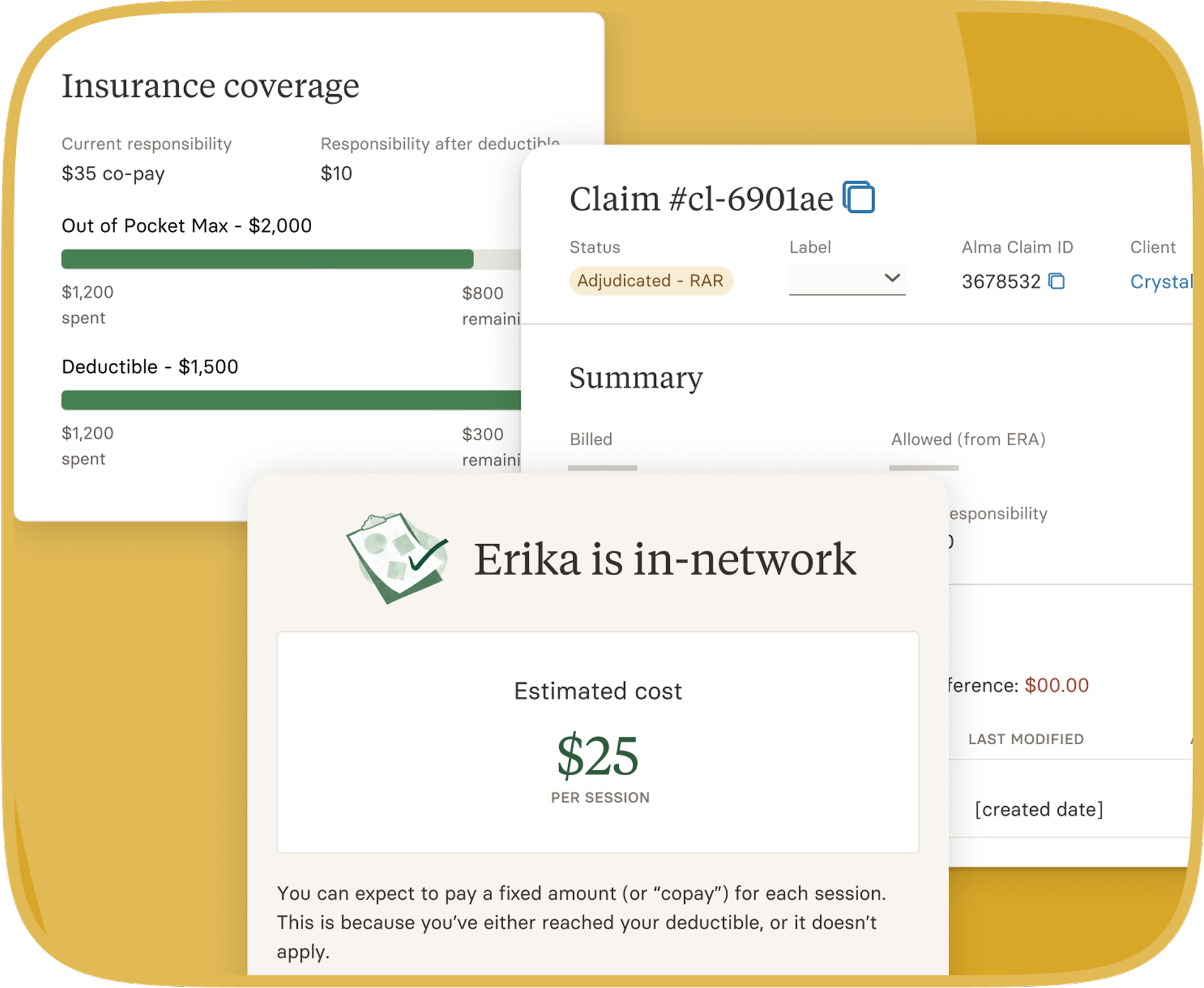

Cost estimator tool for clients

Automated client eligibility checks

Generate claims, invoices, and superbills

Auto-pay and client payment method storage

Track reimbursement status

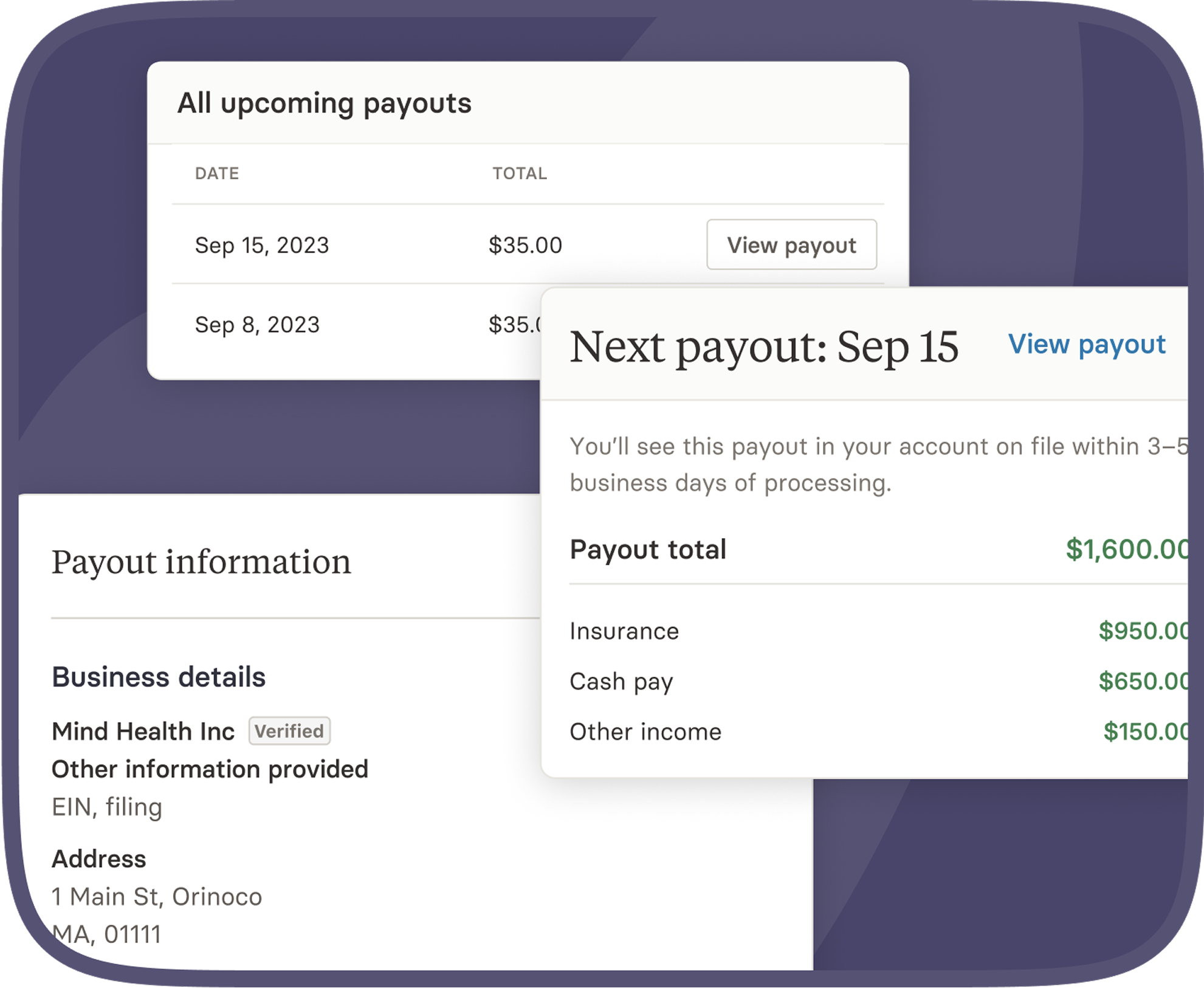

Get reliable payouts and save on administrative fees

Through unique policies, partnerships, and features, Alma finds every opportunity to keep your income consistent and costs low so you can accept insurance with confidence.

Payout Confidence policy—protecting you from unforeseen client payment issues

Competitive reimbursement rates compared to individual applications and similar credentialing programs

Choose a weekly or bi-weekly payout schedules

Alma representatives negotiate claims on your behalf

Lower fees for claims, coverage checks, and credit card processing than other platforms

You don’t have to love working with insurance. We do.

Alma provides clinicians with premium solutions for clinical efficiency and practice growth.

Join to start accepting insurance with ease, from these companies and more:

Frequently asked questions

If you have more questions about how Alma works, you can always reach out to us!

We designed Alma’s insurance program to be easy and financially rewarding for our members. To further our mission of simplifying access to affordable mental health care, all new members are required to join our insurance program and get credentialed with at least one of our payer partners — Aetna, Cigna, or Optum.

Members need to be credentialed under Alma’s Tax ID, regardless of their current individual credential status. Once you’ve been credentialed under Alma's Tax ID, you can add your eligible clients to the Alma portal to access enhanced rates for their sessions.

Members can submit claims directly through the Alma portal — just enter the relevant session codes and hit send. Alma takes care of invoicing your clients and collecting copays.

The only time you’ll need to invoice an insurance client directly is to collect payment for a cancellation or missed visit, should that be a part of your practice’s cancellation policy.

No. We charge a monthly fee for membership that gives you access to all of Alma’s benefits. The income from your cash-pay clients stays with you.

Alma is designed to support your entire practice. We’ll help you manage all of your clients — whether they come to you through Alma or not.

Working with Alma

An Alma membership equips you with everything you need to start and manage a private mental health practice.

Get more out of your practice

One membership gets you everything you need to focus on delivering great care.

Membership options

/month

Billed at $1,140 per year.

Alma membership includes:

Insurance made easy, for you and your clients

Admin and caseload management support

Timesaving tools to streamline care

Community and professional development

Your estimated monthly ROI*

$5,882

- Calculated as 75% of time saved compared to Alma averages, minus the cost of an Alma membership billed annually. Note that the calculator’s results are contingent on using only Alma to manage your practice.

Explore free provider resources

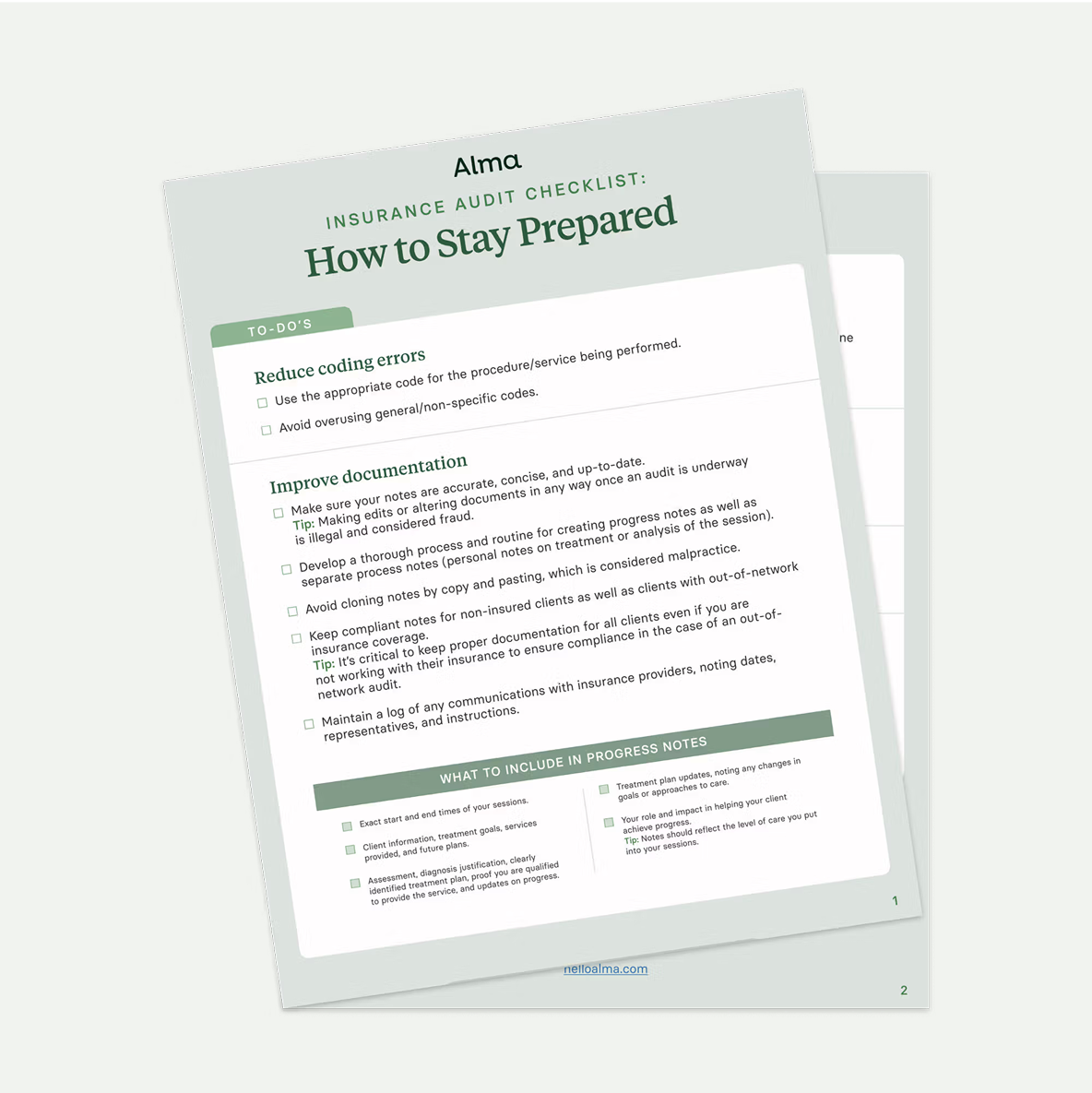

Insurance audit checklist: How to stay prepared

From avoiding coding red-flags to logging communication with insurance providers, here’s how to get and stay buttoned-up.

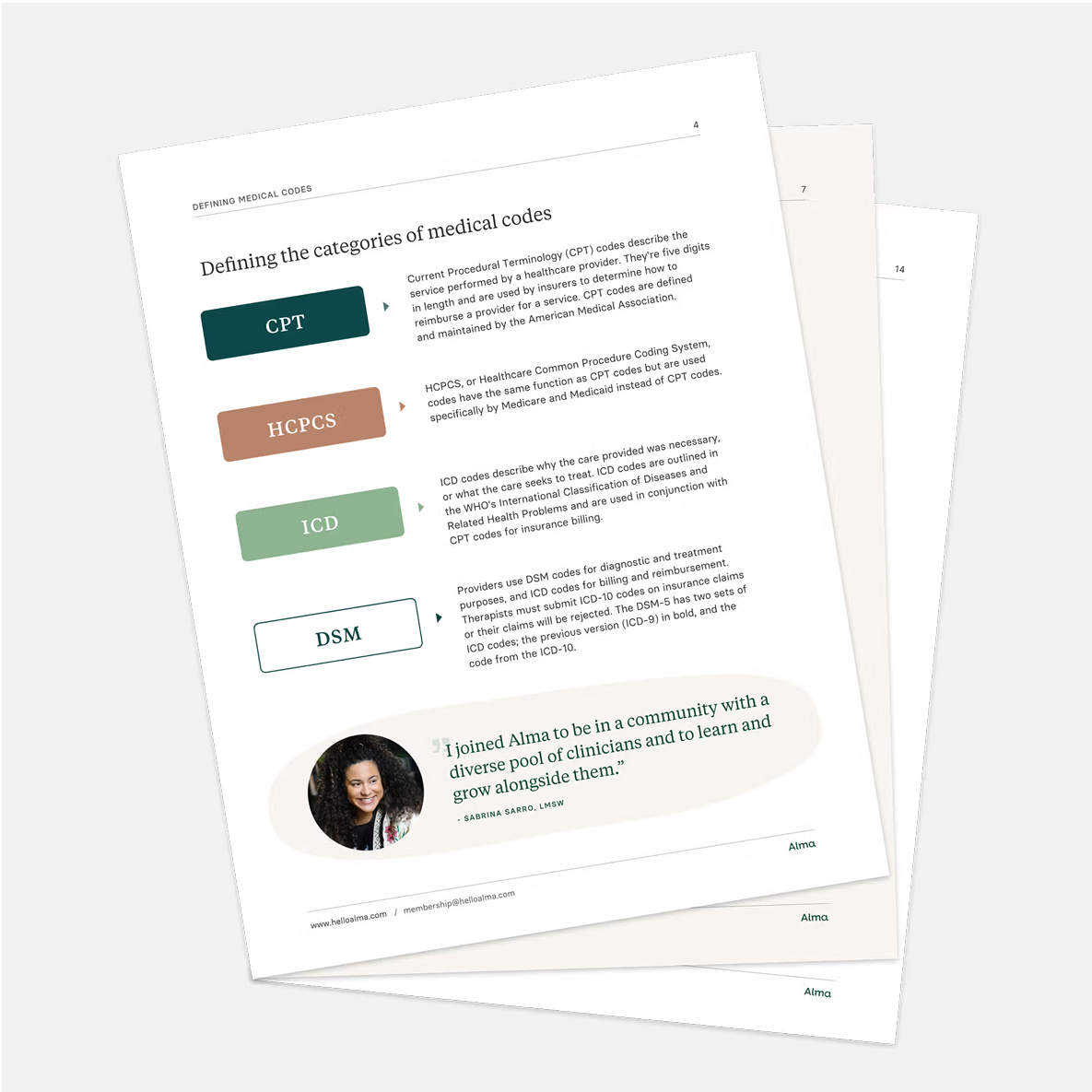

Medical coding & billing eBook

High-level overview of the most commonly used CPT codes, their contexts, and limitations, alongside insights gleaned from processing thousands of insurance claims at Alma.

5 FAQs about accepting insurance

With a foundational understanding of the process, you can simplify operations, fill your caseload faster, and ensure you're getting paid efficiently.

Discover even more reasons to join Alma

EHR tools

Get time back to focus on care with tools that help you establish treatment plans and track patient progress, all while staying HIPAA and insurance compliant.

Wiley Treatment Planners

Use a library of research-backed goals, objectives, and interventions to create treatment plans that meet insurance requirements and client needs.

On-demand CE courses

Alma’s on-demand content library helps you reach your clinical goals and obtain the CE credits you need to meet licensure requirements, entirely on your own terms.